Overview

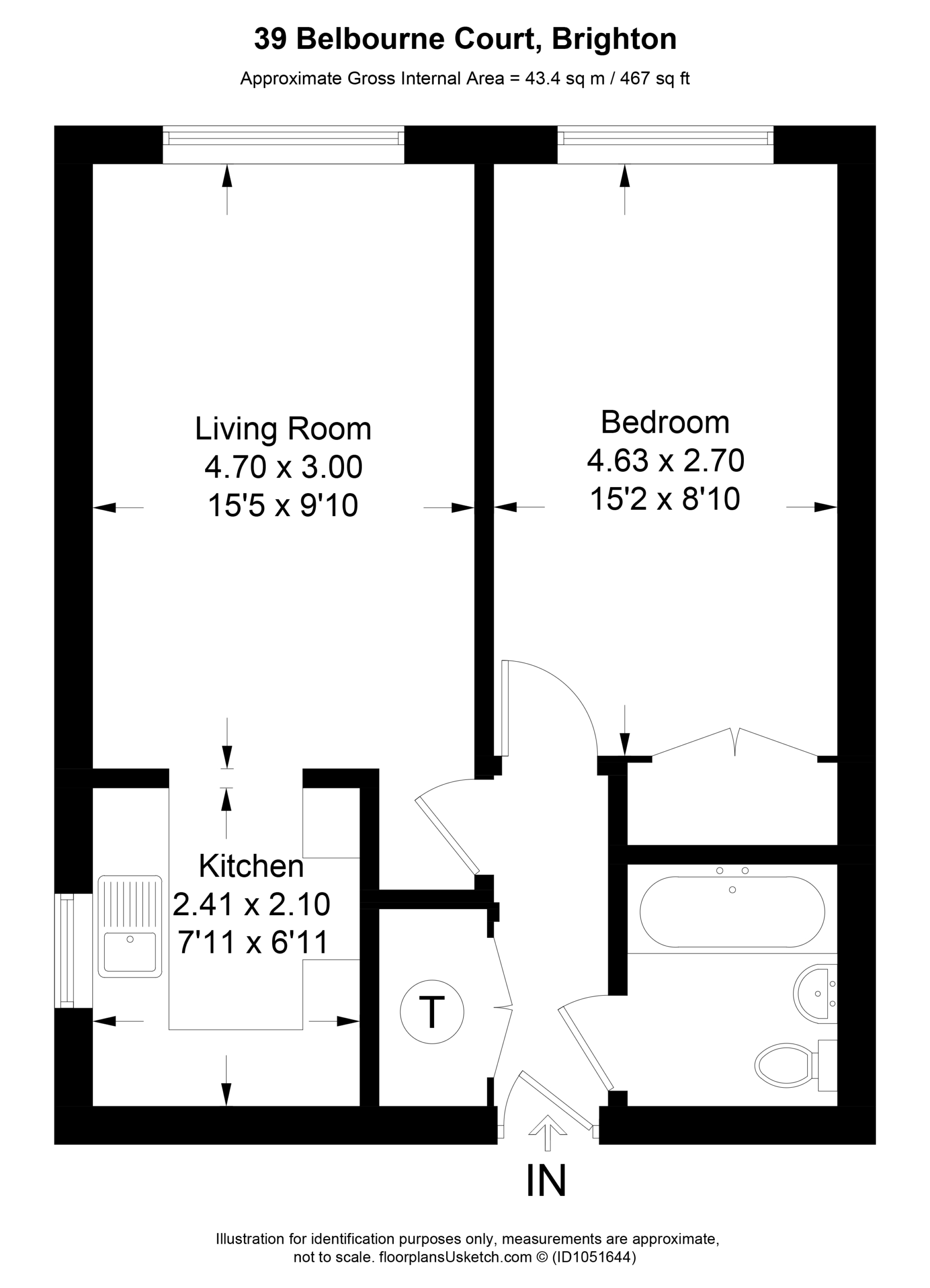

- Flat/Apartment

- 1

- 1

Description

GUIDE PRICE £120,000-£130,000

Welcome to your cozy retirement haven nestled in the heart of Brighton, conveniently located on Bread Street within walking distance to everything this city offers. This charming one bedroom retirement property offers a perfect blend of comfort, convenience, and community.

The property needs modernisation throughout but the location and the community within the building is something we think buyers will love.

Book to view this property

Mortgage Calculator

- Total Monthly Payment

- Please Note: This calculation is a guide to how much your monthly repayments would be. the exact amount may vary from this amount depending on your lender's terms.